AWA Alliance Bank Visa debit and credit cards can now be added to digital pay solutions Apple Pay, Google PayTM and Samsung Pay. See below to find out how to add cards and transact depending on the device you're using.

Apple pay

Adding a card

Adding a card

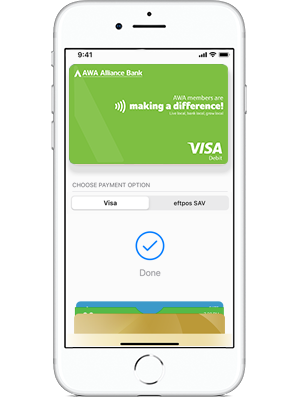

Using Apple Pay is simple and it works with the devices you use every day. Your card information is secure because it isn’t stored on your device or shared when you pay. Paying in stores, apps and on the web has never been easier, safer, or more private.

- Open the Wallet App

- Tap the plus (+) sign in the upper-right corner

- Either take a photo of the physical card or enter the card details manually

- Follow the remaining prompts which will include a verification check (choose from a One-Time Password sent to a mobile phone or email or phone the card verification line as indicated)

When you add your AWA Visa Debit Card to Apple Pay, the card will be defaulted to the Visa network for payments with Apple Pay. To access the eftpos network:

On iPhone

- Open the Wallet app,

- Tap on your AWA Visa Debit Card,

- Tap the more button

- Choose the network

On Apple Watch

- Double-click the side button

- Select your AWA Visa Debit Card

- Firmly press the display

- Choose the network.

Making a payment in store

- Either double tap the home button when the phone is locked or open the Wallet App

- Bring the card into focus that you want to use for the payment

- You will need to authenticate depending on the second-level security being used on the device (Passcode, fingerprint or face recognition)

- Hold the device near the POS terminal when the merchant requests the payment

Google pay

Adding a card

Adding a card

- Download the Google Pay App from the Google Play Store

- Open the Google Pay App

- Go to Payment and add a payment method

- Either take a photo of the physical card or enter the card details manually

- Follow the remaining prompts which will include a verification check (choose from a One-Time Password to a mobile phone or email or phone the card verification line as indicated)

Making a payment in store

- Simply wake your device - there's no need to launch the App or authenticate

- Hold the device near the POS terminal when the merchant requests the payment

Samsung pay

Adding a card

Adding a card

- Open the Samsung Pay App and sign in using your Samsung ID

- Register your fingerprint and device Passcode that you'll use to authorise payments (if you have a Galaxy S8 or Galaxy S8+ or later you can also scan your irises to authenticate)

- Either take a photo of the physical card or enter the card details manually and provide your signature when prompted

- Follow the remaining prompts which will include a verification check (choose from a One-Time Password sent to a mobile phone or email or phone the card verification line as indicated)

Making a payment in store

- Swipe-up from the home button or open the Samsung Pay App

- Bring the card into focus that you want to use for the payment

- You will need to authenticate depending on the second-level security being used on the device (Passcode, fingerprint or iris recognition)

- Hold the device near the POS terminal when the merchant requests the payment

Digital pay FAQs

What AWA cards can be used for digital payments?

The Visa Debit and Visa Credit cards can be added to the digital wallet solutions. The Redicard cannot be used as it does not have contactless functionality.

Are these digital payments secure?

The actual debit or credit card numbers are not stored on your phone or device, so your card details are safe. Additional information on security measures can be found in the specific 'More about' expand areas for each of the digital pay solutions.

Does it cost anything to use digital payments?

No. These are treated as contactless Visa transactions and go through the credit network. Keep in mind some retailers may apply a Visa credit surcharge to purchases and this applies to digital payments. You require an active data plan or Wi-fi connection to add a card to a digital wallet and based upon your mobile plan and network, additional message and/or data charges may apply.

Why are the mobile phone or email details used to verify a new card not the same as the details registered with AWA?

The digital pay solutions use the same details linked to your device (so for instance, on an iPhone the device uses the same details linked to the App Store).

I'm trying to add a brand new card to a digital wallet but I only get one option to authenticate the card and that's to phone the card veritifcation line - why?

This is generally because you have not transacted on the card yet. If you transact using the physical card first you should then see all three verification options (OTP to SMS or email or the card verification line) and if your only option is the card verification line, conducting a transaction will help as they will ask details of the last transaction on the card to then authenticate the card to add to your digital wallet.

What is the transaction limit with digital payments?

As digital payments are processed as contactless (payWave) transactions, the transaction limit is under $100. For transactions over $100 you might be asked to enter your card PIN into the POS terminal.

I made a digital payment for over $100 and it did not ask for my PIN - why?

Certain POS terminals recognise a biometrics authentication such as fingerprint or Face ID on an iPhone to authorise a transaction and therefore do not require additional verification such as the PIN.

How will digital pay transactions appear on my statements?

Transactions will appear as standard Visa transactions. It is not possible to show if a transaction was made using a digital pay solution, contactless card or chip and PIN.

I'm seeing a 'Visa Provisioning Service' transaction on my account - what is this?

If you see a pending transaction for $0.00 with the description 'Visa Provisioning Service (USD)' on the account your AWA card is linked to (the same card that you've just added to a digital wallet), this is part of the authentication process and there is no need to be alarmed. It will disappear after a few days. Of course, if you have any concerns about any transactions on any of your accounts, phone us immediately.

Can refunds be processed to cards in digital wallets?

Some merchants will be able to process refunds back onto cards within digital wallets. If they can, you simply bring the card into focus that you want the refund processed to and then authenticate (if required) and then hold the phone to the POS terminal. Some merchants may need to process the refund using the physical card and a more traditional transaction.

I've just received a renewal card - will I need to update the card details in my digital wallet?

No, the renewal card will automatically replace the existing linked card in your digital wallet.

What should I do if my card is lost or stolen?

If you feel you've misplaced a physical card but it's in a secure environment and you are confident of finding it, you can use the AWA Alliance Bank App to temporarily lock the card. This will also stop the card from working in a digital wallet. Once you've found the card, simply unlock and start using it again. If the card is permanently lost or stolen, you should immediately either use the AWA Alliance Bank App to report the card lost or stolen or phone us.

What should I do if my device is lost or stolen?

You should contact AWA to cancel linked card(s) as this will also cancel them within the digital pay environment.

Can I add, remove and manage cards myself in the digital wallets?

Yes. Within the digital wallet App, you can add and remove cards yourself. If you report a card lost or stolen, you may need to remove the cancelled card depending on the digital pay solution you use. Keep in mind you can also add loyalty cards to your digital wallet for convenience but there are limits on the number of cards that can be stored in your digital wallet.

Apply Pay FAQ's

What is Apple Pay?

Apple Pay is a digital wallet from Apple which lets you use a compatible iPhone, Apple Watch, iPad or Mac to make secure contactless purchase in stores, within selected apps and participating websites.

Which Apple devices can I use?

Apple Pay is available on iPhone, iPad, Apple Watch, Mac with Touch ID, Mac with an Apple Pay enabled iPhone or Apple Watch and the latest OS.

For a list of compatible Apple Pay devices, see https://support.apple.com/en-au/HT208531

Does Apple store the card details?

No, your card details are not stored on the device or in the Cloud. When a card is added to Apple Pay, a Device Account Number replaces the need for the card number.

What is the Device Account Number?

The Device Account Number is used to make secure purchases in stores and within apps and websites. It will not work if it is compromised in any way and cannot be used outside of the device it is assigned to.

Where can I find the Device Account Number?

The Device Account Number can be found by opening the Wallet app, tap the card, then tap the ![]() symbol in the top right corner and then scrolling down to find Device Account Number.

symbol in the top right corner and then scrolling down to find Device Account Number.

Does it cost me anything to use Apple Pay?

No, it does not cost you anything extra to use Apple Pay.

The usual credit or debit charges apply to purchases and some retailers may apply a credit or debit card surcharge to purchases made using any payment method, including Apple Pay, contactless or chip and PIN transactions.

You require an active data plan or Wi-fi connection to add your card to Apple Pay. Based upon your mobile plan and network, additional message and/or data charges may apply.

Setting up Apple Pay

You do not need to download any additional app to use Apple Pay. The latest version of iOS and watchOS is required to set up cards in Apple Pay. Set up Apple Pay link: https://support.apple.com/en-au/HT204506

How do I add a card to Apple Pay?

Adding a card to Apple Pay is different depending upon device:

iPhone

- Open the Wallet app

- Tap the + in the upper right corner, follow the prompts

- Add the card details by either:

- Entering the card’s security code to add the credit or debit card you use with iTunes

- Using the camera to capture the card information

- Typing the card details in manually

Apple Watch

- Open the Apple Watch app on your iPhone

- Tap Wallet & Apple Pay and then Add a new Credit or Debit Card, follow the prompts

- Add the card details by either:

- Entering the card’s security code to add the credit or debit card you use with iTunes

- Using the camera to capture the card information

- Typing the card details in manually

iPad

- Go to Settings

- Tap Wallet & Apple Pay and then Add Credit or Debit Card, follow the prompts

- Add the card details by either:

- Entering the card’s security code to add the credit or debit card you use with iTunes

- Using the camera to capture the card information

- Typing the card details in manually

How do I activate my card with Apple Pay?

For security purposes, when a new card is added to Apple Pay we’ll ask you to complete a verification check before it can be used with Apple Pay. We’ll either:

- Send a one-time password to the mobile phone number you have registered with us

- Send a one-time password to the email address you have registered with us

- Ask you to call us on 1300 056 953 and answer some security questions

Can a single card be added to multiple Apple Pay wallets?

Yes, a card can be added to Apple Pay on multiple devices, however the card will need to be added to each device separately.

How do I change the default payment network?

When you add your AWA Visa Debit Cardto Apple Pay, the card will be defaulted to the Visa network for payments with Apple Pay.

To change the payment network on iPhone

- Open the Wallet app,

- tap on your AWA Visa Debit Card

- tap the

symbol and choose the network.

symbol and choose the network. - You can also change the payment network prior to tapping your device. Simply, authenticate, choose network on screen, then tap device for payment.

To change the payment network on Apple Watch

- double-click the side button and select your AWA Visa Debit Card

- firmly press the display and choose the network.

Using Apple Pay

Where can I use Apple Pay?

You can use your device to make a payment using Apple Pay in stores or anywhere you can tap and pay. Apple Pay can also be used within apps or on participating websites wherever they see the buy with Apple Pay mark.

![]()

How do I make payment in stores with an iPhone?

Pay with iPhone with Face ID

- To use your default card, double-click the side button, then glance at your iPhone to authenticate with Face ID, or enter your device passcode.

- Hold the top of your iPhone within a few centimetres of the contactless reader until you see Done and a tick on the display.

Pay with iPhone with Touch ID

- To use your default card, rest your finger on Touch ID.

- Hold the top of your iPhone within a few centimetres of the contactless reader until you see Done and a tick on the display.

How to use Apple Pay link: https://support.apple.com/en-au/HT201239

How do I make payment in stores with an Apple Watch?

Pay with Apple Watch

- To use your default card, double-click the side button and hold the display of your Apple Watch within a few centimetres of the contactless reader.

- Wait until you feel a gentle tap.

When you strap your Apple Watch to your wrist you will be prompted to enter the device passcode. This will enable Apple Pay. If the Apple Watch is removed from your wrist, so skin contact is lost, Wrist Detect detects that skin contact has been lost and Apple Pay and the NFC feature are deactivated.

How do I make payment within an app or on participating websites?

With your iPhone, iPad and Apple Watch, you can use Apple Pay to pay within apps when you see Apple Pay as a payment option.

To pay with Apple Pay within an app:

- Tap the Apple Pay button or choose Apple Pay as your payment method.

- Check your billing, shipping and contact information to make sure that they're correct. If you want to pay with a different card, tap

next to your card.

next to your card. - If you need to, enter your billing, shipping and contact information on your iPhone or iPad. Apple Pay will store that information, so you won't need to enter it again.

- Confirm the payment. When your payment is successful, you'll see Done and a tick on the screen.

- iPhone X or later or iPad with Face ID: Double-click the side button, then use Face IDor your device passcode.

- iPhone 8 or earlier or iPad without Face ID: Use Touch ID or your device passcode.

- Apple Watch: Double-click the side button.

Can I use Apple Pay to make a payment on the web in Safari?

Yes. With your iPhone or iPad

- Tap the Apple Pay button.

- Check your billing, shipping and contact information to make sure that they're correct. If you want to pay with a different card, tap next to your card.

- If you need to, enter your billing, shipping and contact information. Apple Pay will store that information, so you won't need to enter it again.

- When you’re ready, make your purchase and confirm the payment.

- iPhone X or later or iPad with Face ID: Double-click the side button, then use Face IDor your device passcode.

- iPhone 8 or earlier or iPad without Face ID: Use Touch ID or your device passcode.

- Apple Watch: Double-click the side button.

- When your payment is successful, you’ll see Done and a tick on the screen.

With your Mac models with Touch ID

- Tap the Apple Pay button.

- Check your billing, shipping and contact information to make sure that they're correct. To pay with a different card instead of your default card, click

next to your default card and select the card you want to use.

next to your default card and select the card you want to use. - If you need to, enter your billing, shipping and contact information. Apple Pay will store that information, so you won't need to enter it again.

- When you're ready, make your purchase. Follow the prompts on the Touch Bar and place your finger on Touch ID. If Touch ID is off, tap the Apple Pay icon on the Touch Bar and follow the prompts on the screen. When your payment is successful, you'll see Done and a tick on the screen.

With other Mac models

- You need an iPhone or Apple Watch to confirm payments. Make sure that you're signed in with the same Apple ID on all your devices.

- Make sure you've turned on Bluetooth on your Mac.

- Tap the Apple Pay button.

- Check your billing, shipping and contact information to make sure that they're correct. To pay with a different card instead of your default card, click

next to your default card and select the card you want to use. You can choose credit and debit cards or Apple Cash from any iPhone or Apple Watch that is nearby and signed into the same iCloud account.3

next to your default card and select the card you want to use. You can choose credit and debit cards or Apple Cash from any iPhone or Apple Watch that is nearby and signed into the same iCloud account.3 - If you need to, enter your billing, shipping and contact information. Apple Pay will store that information on your iPhone, so you won't need to enter it again.

- When you're ready, make your purchase and confirm the payment.

- iPhone X or later: Double-click the side button, then use Face IDor your device passcode.

- iPhone 8 or earlier: Use Touch ID or your device passcode.

- Apple Watch: Double-click the side button.

- When your payment is successful, you'll see Done and a tick on the screen.

Is there a transaction limit when using Apple Pay in store?

No, there is no transaction limit for Apple Pay transactions. Depending on the store and transaction amount, you might need to sign a receipt or enter your PIN.

How do I return an item purchased with Apple Pay in stores?

You take the item(s) back to the retailer as normal. Some retailers will be able to offer refunds back to the device from which the original payment was made, while other may have to refund the plastic card.

You may need to provide the last four digits of the Device Account Number to the retailer. This can be found by opening the Wallet app and tapping the ![]() symbol in the top right corner and then scrolling down to find Device Account Number.

symbol in the top right corner and then scrolling down to find Device Account Number.

Will I be able to view my Apple Pay transactions within the Wallet app?

Yes, you will be able to view the last 10 transactions made using Apple Pay on that device within the Wallet app. eftpos transactions made using your AWA Visa Debit Cardwith Apple Pay can currently only be viewed via our mobile app.

Will I be able to view my Apple Pay transactions in my bank statement?

Transactions will appear as they normally do on a bank or credit card statement.

Can I get cash out with my AWA Visa Debit Card card with Apple Pay?

You may be able to get cash out at selected merchants with your AWA Visa Debit Card card by selecting 'eftpos CHQ' or 'eftpos SAV' in Apple Pay.

Is Apple Pay secure?

Yes, Apple Pay is secure. A unique Device Account Number is securely stored on a chip in the device so payment can be made without any card information having to be shared with the retailer.

Other features which help to keep your payments secure and safe include:

iPhone and iPad

All transactions require authentication using Face ID, Touch ID (if enabled), or by entering the device passcode.

Apple Watch

Payments can only be authorised if the device passcode has been entered and skin contact with the device has not been lost. If the device has been removed from your wrist, Wrist Detect deactivates the NFC feature and Apple Pay. To re-activate the NFC feature and Apple Pay the device passcode has to be entered again.

Please note: you should never share your device passcode, or register more than one person’s Face ID, or Touch ID, while your card is registered to Apple Pay.

Managing cards

How do I change my default card?

The first card added to the Wallet app becomes the default card for that device. To change a default card you must follow these steps:

iPhone

- Open the Wallet app

- Touch and hold your finger over the card you want to make the default card

- Drag the card to the front of the cards in the Apple Pay section

Apple Watch

- Open the Watch app on your iPhone

- Go to the My Watch tab

- Tap Wallet & Apple Pay and then Default Card

- Choose a new card

iPad

- Go to Settings

- Tap Wallet & Apple Pay and then Default Card

- Choose a new card

How do I remove a card from Apple Pay?

To remove a card from Apple Pay you must follow these steps:

iPhone

- Open the Wallet app

- Select the relevant card and then tap

symbol in the top right corner to see all the card details

symbol in the top right corner to see all the card details - Scroll down and select Remove Card

Apple Watch

- Open the Watch app on your iPhone

- Go to the My Watch tab

- Scroll down and tap Wallet & Apple Pay

- Tap the card and then tap Remove Card

iPad

- Go to Settings

- Scroll down and tap Wallet & Apple Pay

- Tap the card and then tap Remove Card

For more information about managing your cards with Apple Pay visit https://support.apple.com/enau/HT205583

Please note: if you remove your device passcode or Face ID, Touch ID security feature, or sign out of iCloud, all cards will be removed from Apple Pay on the device.

How to do I update my AWA Visa Debit Cardin Apple Pay to include the eftpos payment network?

To update your Card on iPhone and Apple Watch

- Remove your AWA Visa Debit CardCard from Apple Pay on your iPhone

- Open Wallet, tap your AWA Visa Debit CardCard, tap

, then tap Remove Card.

, then tap Remove Card.

- Open Wallet, tap your AWA Visa Debit CardCard, tap

- Remove your AWA Visa Debit CardCard from Apple Pay on your Apple Watch

- Open the Watch app on your iPhone, go to the My Watch tab, tap Wallet & Apple Pay, tap the card, then tap Remove Card.

- Add your AWA Visa Debit Cardback into Apple Pay on your iPhone

- On iPhone, Open the Wallet app, tap the “+” sign in the upper-right corner then tap ‘Add a Different Card’ follow the prompts. (Do not choose previously provisioned card option)

- Update your Card on Apple Watch

- Add your AWA Visa Debit Cardback to Apple Pay on your Apple Watch

- Open the Apple Watch app on your iPhone, tap “Wallet & Apple Pay” tap "Add Card” and select ‘Add a Different Card’ at the bottom of the screen, follow the prompts (Do not choose previously provisioned card option)

- For more information visit: https://support.apple.com/en-au/HT209137

What should I do if my card is lost or stolen?

You should contact us straight away on 1300 056 953 so the lost or stolen card can be cancelled and no further purchases made. When the replacement card is issued we will automatically update Apple Pay with your new card details. You can continue to make purchases using Apple Pay before your new card arrives. You may be limited to transactions under $100 until your new PIN arrives.

What should I do if my iPhone or iPad is lost or stolen?

If you have the Find My iPhone app you can use it to remotely lock the device and disable the use of the Apple Pay function. Or you can log into iCloud.com and remove all cards from Apple Pay remotely. If you do not have the app you should contact us on 1300 056 953 to request that your card be disable for use with Apple Pay.

What should I do if my Apple Watch is lost or stolen?

You should contact us on 1300 056 953 to request that your card be disable for use with Apple Pay. You should also go to iCloud.com and remove your card from Apple Watch. If you find your Apple Watch you can add your card back by following the same steps you went through when you set the card up with Apple Pay originally.